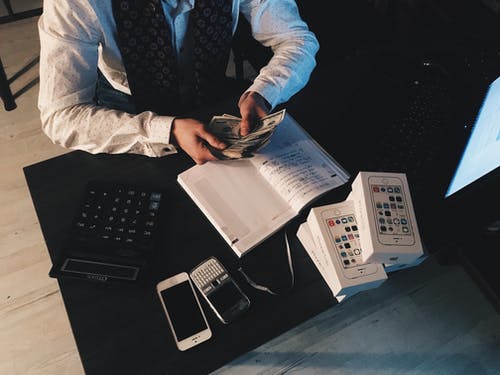

By managing the finances of a small business wisely, you will be able to assess whether there is room for growth and most importantly, how you can implement a business plan for higher profits. There are many accounting firms that you can liaise with to get a better understanding of your finances and recommendations for increasing revenue and business growth.

Saving Valuable Time

The term ‘time is money’ best describes how crucial it is for a business owner. It is not just profit that you have to look at; you need to develop your brand, customers and the strength of your business. You will not be able to expand and find new customers if you are not careful of the time wasted on inane tasks. There also has to be a good balance between your work life and personal life. But this is something hard to maintain especially if you have just started a business. Finances take a lot of time to manage and it has a big impact on the value of your company.

At the beginning of a small business venture, you will have certain responsibilities such as bookkeeping, keeping on top of receipts and tax returns along with setting practical and reachable financial goals. You can delegate these time consuming tasks to an accountant making sure that your finances are in good hands. With best small business accountant Melbourne, you can make sure to maintain a good work life balance.

Cost Saving Strategies

You may not be aware of all the tips and tricks that can help cut down on costs. An accountant will keep you apprised of what strategies can be employed in order to avoid spending money unnecessarily. They can also make sure that you are not overpaying for resources. There can also be mistakes where you can forget to do regular payments to suppliers or lenders. An accountant will make sure that they vigilantly keep track of regular expenses.

Management of Complex Accounting

There are a lot of years involved in becoming an accountant with the necessary skills and certification to work in the industry. While bookkeeping will not require professional skills, there are other accounting tasks that can be quite complicated as well as time consuming. You will not always start out with clear accounting knowledge when you’re first building your personal brand. But you have to understand that mistakes in accounts can cost you dearly and this is something that you cannot afford as a small business. You can give over complex accounting to a professional to make sure that your revenue doesn’t take a loss just because of simple errors.

Managing Taxes

There are strategies that can be implemented to reduce your tax bill. An expert accountant can advise you on what can be done and when to use these methods. All these strategies are going towards saving unnecessary costs and keeping your revenue up. The money that you save through smart cost saving can in turn be invested back into your business.